If you or someone you care about is living with a disability in Canada, you might be eligible for the Disability Tax Credit (DTC). It’s a government benefit that can translate into thousands of dollars of tax credits which is applied at income tax time. Currently, over a million Canadians receive this credit every year.

But like many government benefits, navigating the application and approval process can be a challenge and may require the assistance of a consultant who understands the ins and outs of the process. For those of you who feel you may qualify, read on as we attempt to provide a primer on the DTC to get things started:

What is the Disability Tax Credit?

The DTC is a tax credit offered by the federal government. It was designed to help Canadians with qualifying physical or mental impairments so that they can cover the potentially onerous costs associated with managing a disability. If approved, the result is a financial credit applied against any income tax owing. In some cases, this can translate into tens of thousands of dollars. Furthermore, for those who qualify and who don’t earn enough income to make it count, the credits can be transferred to a spouse, parent, dependent, or select others in your family.

Who is Eligible?

You may qualify for the DTC if you have a severe and prolonged disability that impacts your ability to do basic activities of daily life. The government qualifies this as difficulty:

- Walking or feeding yourself

- Hearing or speaking

- Seeing

- Remembering or focusing

- Managing bowel or bladder functions

- Needing life-sustaining therapy (like dialysis or insulin)

The condition must last (or be expected to last) at least 12 months, and it must make things significantly harder for you, even if you’ve found ways to adapt.

Eligibility for this disability benefit is based on how your condition affects your life and your ability to work (or not work)— and not just on a diagnosis. It is really your doctor who will have to attest to the fact that the condition impacts you enough to qualify. And that’s where it can sometimes get tricky, as not all doctors view a disability in the same way, nor are they up to speed on what criteria carries the most weighting for the CRA’s personnel who make the final call.

Who Should I Ask to Certify Impairment?

The Government of Canada outlines who is eligible to verify your disability status:

| Medical doctor | All impairments |

| Nurse practitioner | All impairments |

| Optometrist | Vision |

| Audiologist | Hearing |

| Occupational therapist | Walking, feeding, dressing |

| Physiotherapist | Walking |

| Psychologist | Mental functions |

| Speech-language pathologist | Speaking |

There may be fees associated with certification from the professional who is assessing you, including your own doctor. This is not a service that is “insured” by provincial medicare. You will be responsible for paying this fee, though you can claim it as a medical expense on your taxes.

How Do You Apply?

The application form is called the T2201 Disability Tax Credit Certificate, which has two parts:

- Part A: You fill this out with your basic information. This can be done online through the CRA’s website under the benefits and credits section. Alternatively, it can be completed over the phone by calling the CRA. “You have the option to talk to a call centre agent (1-800-959-8281) or use the automated voice service (1-800-463-4421),” according to the GoC website. You will receive a referral number to give to your doctor.

- Part B: Once they receive the referral number, your medical practitioner (such as a doctor, nurse practitioner, or occupational therapist) must fill out the section that describes your disability and how it affects your daily life.

Part B is automatically submitted to the CRA for review. Once your documents are in order, you can submit them through the CRA website under My Account and Submit Documents.

How Long Does It Take?

As of August 2025, it can take up to 15 weeks for the Canada Revenue Agency (CRA) to review your application for the disability benefit. Check this website to see what the current estimated processing time is. If the CRA needs more information, it could take longer before they make a final decision.

Once approved, the CRA will let you know how many years you’re approved for. You can be approved for up to 10 years at a time. There is no limit to how many times you can reapply, whether your application was successful or not.

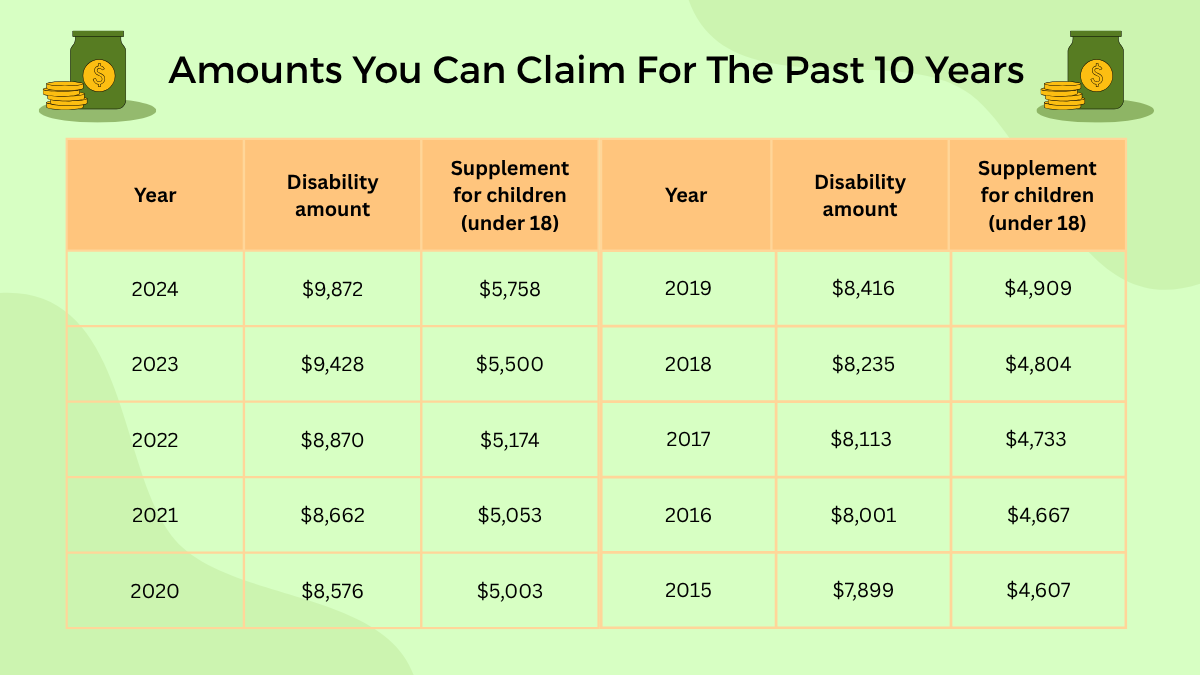

Furthermore, if you were eligible during previous years but didn’t submit an application, you may be able to get a refund going back as far as 10 years.

How Much Can I Get?

The Disability Tax Credit doesn’t give you a direct payment. Instead, it lowers the amount of income tax you (or a supporting family member) owe each year. Here’s how it works:

As of the 2024 tax year, the federal amount for the DTC is about $9,800 if the claimant is over 18 years old. That means if you’re approved, you can claim $9,500 as a non-refundable tax credit when you file your taxes. If the person with the disability is under 18, they can also claim about $5,700 for each child on top of the base amount.

Depending on your federal tax bracket, that will change the amount you can receive from the disability benefit.

You might also qualify for an additional amount from your province or territory. Each one has its own DTC amount and tax rate. That can add a few hundred more dollars per year, depending on where you live.

Find out how much you may be able to get from the DTC using the new Government of Canada estimator!

What About Back Payments?

If you’re approved for previous years (for example, if your condition started several years ago), you could receive a retroactive tax refund going back as far as 10 years. This can add up to thousands of dollars in total savings.

For example: If you’re approved for 5 previous years plus the current year and your total annual federal and provincial savings come to $1,800/year, then you could receive up to $10,800 in total tax relief from the disability benefit. But remember, this is not money in your pocket. This is the amount you can claim against your income on your taxes.

What If You Don’t Pay Taxes?

If the person with the disability doesn’t earn enough to pay income tax, the credit can be transferred to a spouse, parent, or other supporting family member who does pay taxes — as long as they help provide care or financial support.

That way, your household still benefits from the credit, even if your personal income is low or non-existent.

Can Someone Help You Apply?

There are companies and consultants that can help people apply for the disability benefit. They can be helpful if you believe you should qualify but find it too confusing or have been declined in the past, or if English isn’t your first language.

It’s important to know what these companies do. You’ll need to find a trustworthy company that you can trust with your medical and financial information. Typically these companies will:

- Help gather and review your documents

- Try to guide the attending physician to complete the document in the most favourable way.

- Communicate with the CRA on your behalf

- Charge a percentage of your refund (often 20–30 per cent)

If you decide to go this route, be sure to read the contract carefully. These companies are legal, but they will take a percentage of your resulting credit (ie. 25% in many cases).. If you and your physician feel your case is strong enough without additional help, you can try to apply on your own and without the additional cost of a consultant.

If you need extra help but want to avoid big fees, consider calling a community legal clinic or contacting a non-profit disability organization in your area. While they don’t offer the same level of service, some clinics and organizations may offer support for free or low cost.

Apply Now!

The Disability Tax Credit exists to support Canadians living with serious and long-term disabilities. While the application process for this disability benefit can feel intimidating, taking the time to apply can lead to significant financial relief.

Whether you choose to apply on your own or with help, understanding your rights and options can make the process smoother—and get you one step closer to the support you deserve.

~ Read more from The Health Insider ~

- Beyond the Diagnosis: Navigating Life with GI Disorders

From debunking social media myths to providing peer support, learn how the GI Society helps patients manage the “new normal” of digestive health.

From debunking social media myths to providing peer support, learn how the GI Society helps patients manage the “new normal” of digestive health. - Doctors Warn Canadians are “5x More Likely” to Experience Harm from AI Health Advice

SummaryA Feb 2026 CMA report warns that following health advice from AI leads to 5x more medical harm. While Canadians use these tools for speed, 77% are worried about U.S. misinformation. Doctors are calling for urgent regulation to ensure AI enhances care rather than endangering patients. A new report released today by the Canadian Medical…

SummaryA Feb 2026 CMA report warns that following health advice from AI leads to 5x more medical harm. While Canadians use these tools for speed, 77% are worried about U.S. misinformation. Doctors are calling for urgent regulation to ensure AI enhances care rather than endangering patients. A new report released today by the Canadian Medical… - Exercise Variety: The Secret to Longevity?

New research shows exercise variety is just as vital as volume. Learn why diversifying your workouts can slash mortality risk by up to 19%.

New research shows exercise variety is just as vital as volume. Learn why diversifying your workouts can slash mortality risk by up to 19%.

The information provided on TheHealthInsider.ca is for educational purposes only and does not substitute for professional medical advice. TheHealthInsider.ca advises consulting a medical professional or healthcare provider when seeking medical advice, diagnoses, or treatment. To read about our editorial process, click here.